How to Download Forecloser letter in Bajaj Finserv App?

A Foreclosure letter is an important document that helps confirm the pre-closure or early settlement of a loan. If you have paid off your loan before the due tenure, Bajaj Finserv allows you to download a foreclosure letter easily through its mobile app. This document is essential for both personal and legal purposes as it provides proof that your loan account has been settled.

This easy process ensures that you can access important loan documents anytime, making it hassle-free to maintain records of your loan settlements. Bajaj Finserv's mobile app provides a user-friendly interface to help manage all your loan-related needs efficiently.

Foreclosure Letter Download Process

- Login to the App: Open the Bajaj Finserv app on your mobile device. Log in using your credentials. If you don't have an account, you may need to register.

- Navigate to Loan Account: Once logged in, find and select the option related to your loan account. This might be labeled as "Loan Account," "My Loans," or something similar.

- Locate Foreclosure Section: Look for a section or option related to foreclosure or pre-closure. This is where you might find details and documents related to closing your loan.

- Request Foreclosure Letter: Within the foreclosure section, there may be an option to request or download a foreclosure letter. This letter typically outlines the details of your loan closure.

- Follow Instructions: Follow the on-screen instructions to request the foreclosure letter. This might involve providing specific details or selecting the loan account for which you need the letter.

- Download or Receive the Letter: After processing the request, you can download the foreclosure letter directly from the app. Alternatively, the letter might be sent to your registered email address or be available in a document section within the app.

- Contact Bajaj Customer Care (if needed): If you're unable to find the option or face any issues, it's advisable to contact Bajaj Customer Care (tel:086980 10101). They can guide you through the process and provide specific instructions based on the current features of the app.

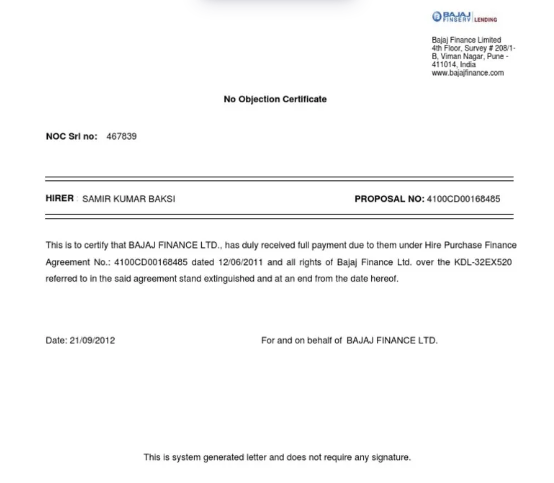

Foreclosure Letter Format

Bajaj Foreclosure Charges

- Bajaj Finance charges a foreclosure fee of 4.72% (inclusive of applicable taxes) on the outstanding loan amount if you decide to repay your loan before the end of the tenure. This fee helps cover the lender's potential loss of interest and administrative costs

FAQs:

What is a foreclosure letter in Bajaj Finserv?

- A foreclosure letter for a home loan is an official document from the lender confirming the borrower’s request to repay the full loan amount before the scheduled tenure ends.

What is meant by a foreclosure letter?

- When a borrower repays the entire outstanding loan amount in one payment rather than in EMIs, they need to write a letter for the foreclosure of the loan, which is known as the foreclosure letter.

What are the foreclosure charges for Bajaj Finance?

- Bajaj Finance charges a foreclosure fee of 4.72% (inclusive of applicable taxes) on the outstanding loan amount if you decide to repay your loan before the end of the tenure. This fee helps cover the lender's potential loss of interest and administrative costs

How do I get a loan foreclosure letter?

- How To Obtain a Loan Foreclosure Letter From a Bank? Write a foreclosure letter to the bank, including your loan account number, a copy of your PAN card, and address proof. Once the bank receives your request, they will calculate the outstanding amount and inform you. Pay the amount via NEFT, RTGS, or cheque, along with applicable foreclosure charges. Finally, ensure you collect a no-dues certificate and submit any required documents.

Are there any foreclosure charges deductions?

- Yes, there will be foreclosure charges which will be deducted as a part of the bank’s policy.

What are the advantages of a loan foreclosure?

- Prepaying your current personal loan in full or foreclosing it is deemed favorable and can help you raise your CIBIL score. An enhanced credit score can help you conclude your next loan application faster and negotiate better terms with the lender.

Can I foreclose my EMI with Bajaj Finserv?

- If you have surplus funds during your loan tenure, you can foreclose the loan by paying the outstanding amount. Foreclosure is allowed anytime after the first EMI, but a foreclosure charge may apply.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()