Axis Bank provides you with various options to apply for a Fixed Deposit - online, mobile, or by visiting the nearest Axis Bank branch. Here are 5 easy steps in which you can apply for Fixed Deposit online or via the Mobile App. Additionally, you can drop by at your nearest Axis Bank branch and ask any of our representatives to guide you.

Fixed Deposit via Mobile Banking:

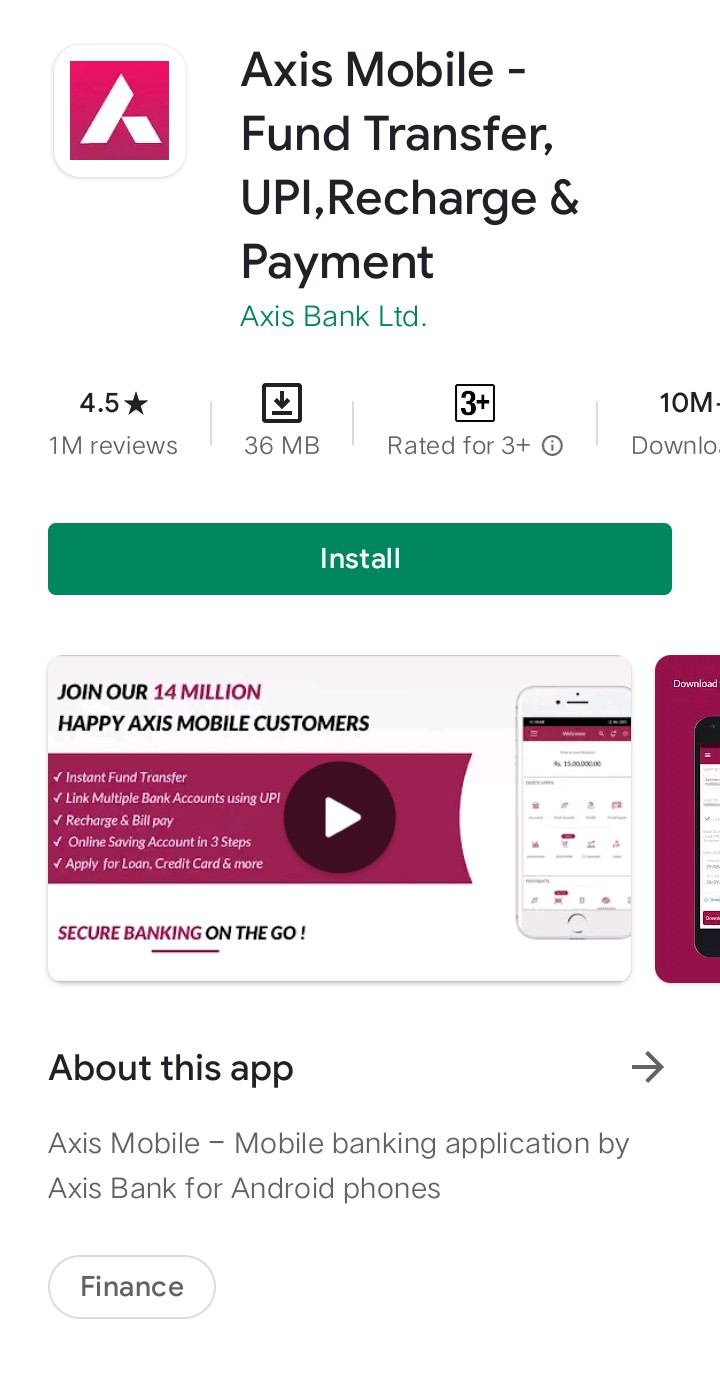

Download and Install the App:

- Make sure you have the Axis Bank mobile banking app installed on your smartphone. You can download it from the official app store for your device.

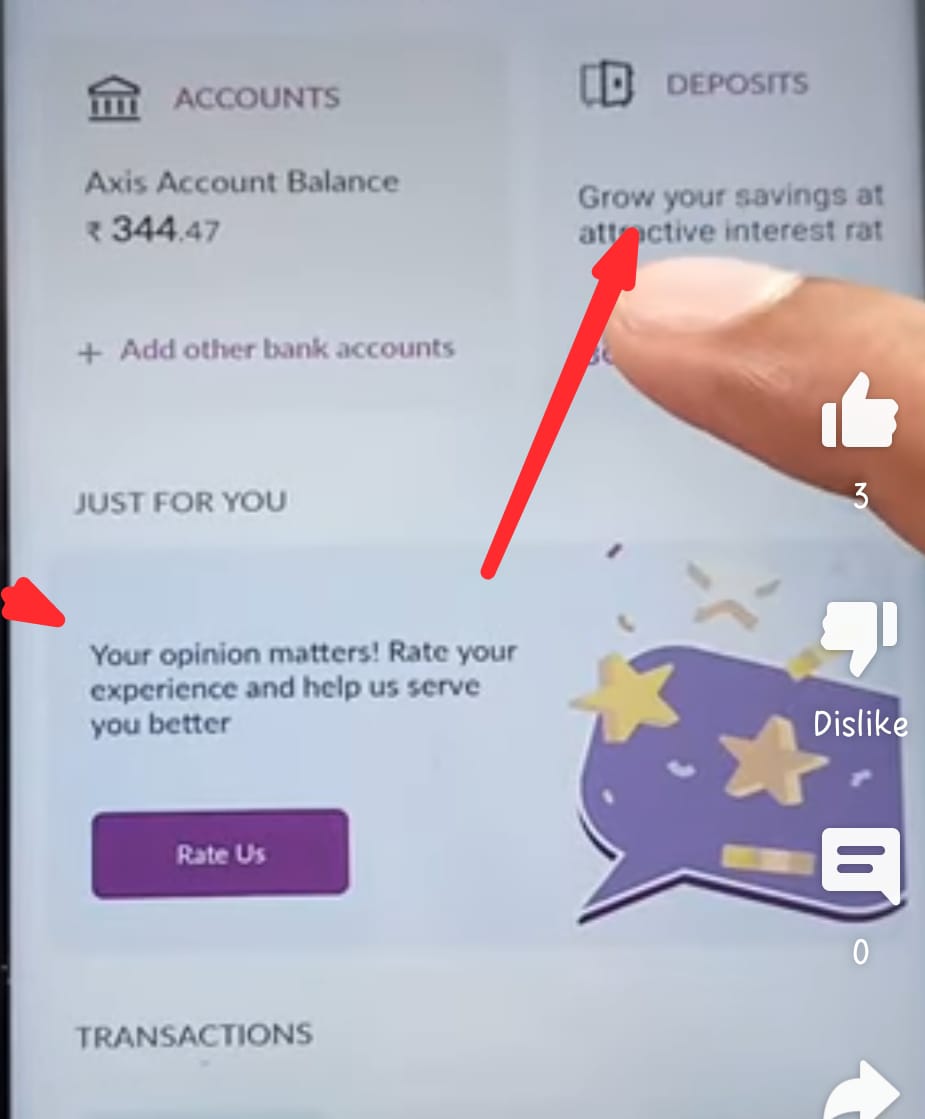

Login or Register:

- Open the app and log in using your credentials. If you don't have an account, you'll need to register and set up your mobile banking profile.

Navigate to Fixed Deposits Section:

- Once logged in, find the "Fixed Deposits" or "Deposits" section within the app. This is typically located in the main menu or home screen.

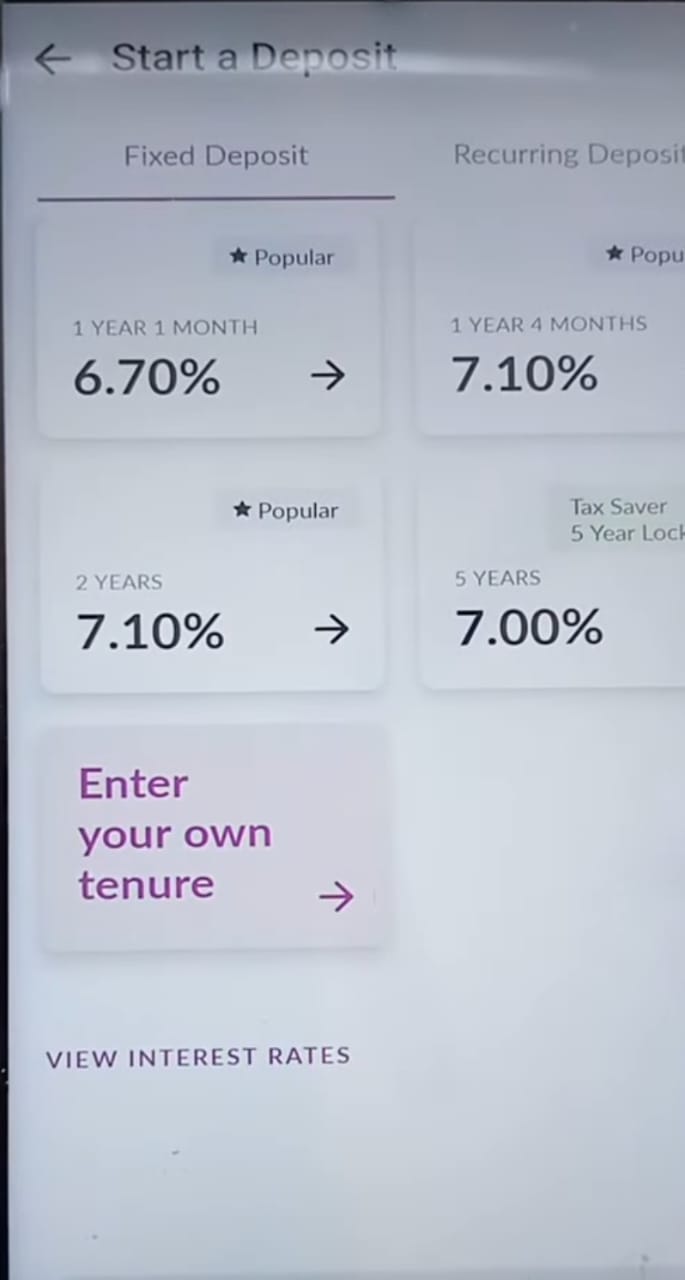

Choose Deposit Type:

- Select the type of fixed deposit you want to open. This may include options such as regular fixed deposits, tax-saving fixed deposits, or special term deposits.

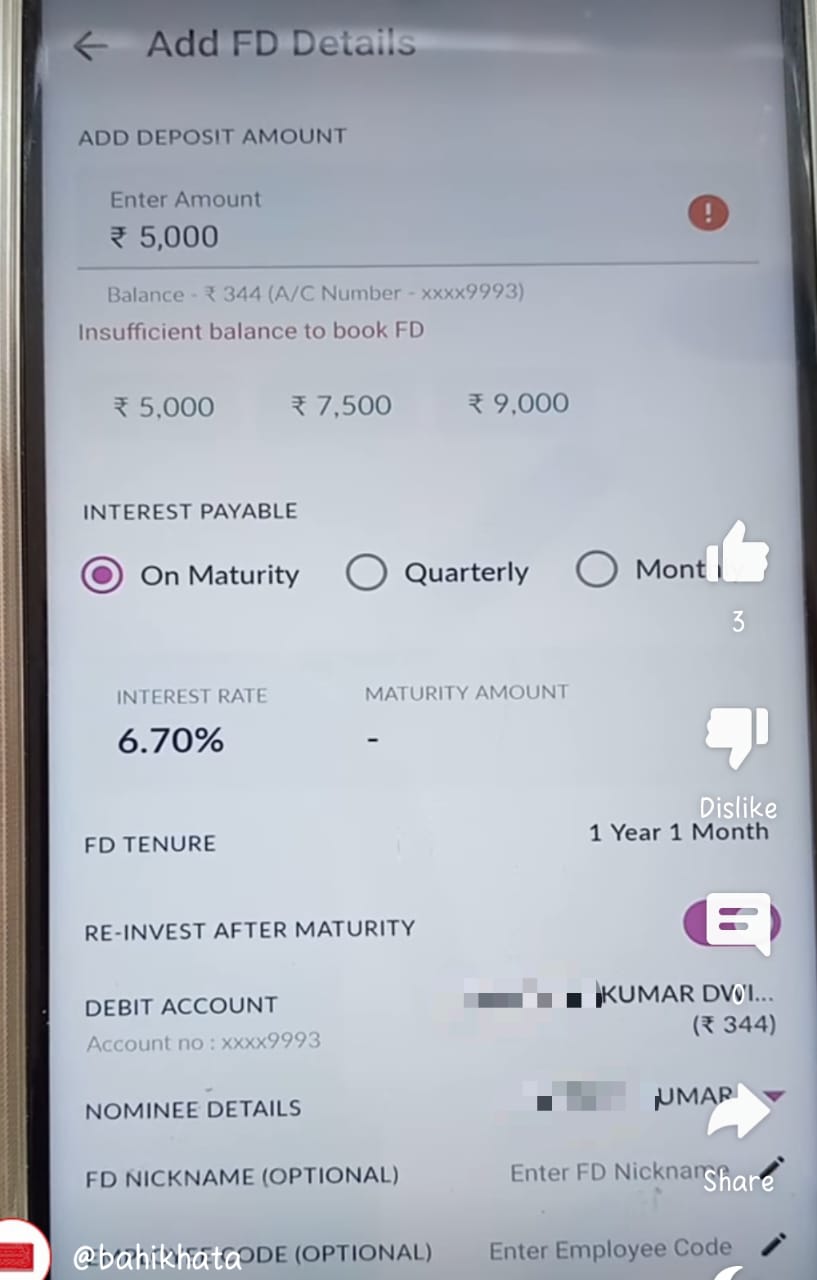

Enter Deposit Details:

- Fill in the required details such as the deposit amount, tenure (duration of the fixed deposit), and any other relevant information.

Select Interest Payout Option:

- Choose how you want the interest to be paid out (monthly, quarterly, annually, or at maturity).

Nominee Details:

- Provide details of the nominee for the fixed deposit, if applicable.

Review and Confirm:

- Review all the entered information and confirm that it is accurate. Some apps may provide a summary for you to double-check before confirming the transaction.

Authenticate the Transaction:

- Depending on the app's security features, you may need to authenticate the transaction using methods like OTP (One-Time Password), mPIN, or biometric authentication.

Confirmation:

- After successful authentication, you should receive a confirmation of the fixed deposit creation. This may include details like the FD account number and confirmation of the terms.

Benefits for you

- Save funds for a fixed tenure and enjoy a fixed rate of return

- Flexible maturity periods ranging from 7 days to 10 years

- Earn secured returns and build a corpus to meet your needs

Fixed Deposit via Internet Banking:

While We can provide a general guide on how to apply for a fixed deposit through internet banking with Axis Bank.

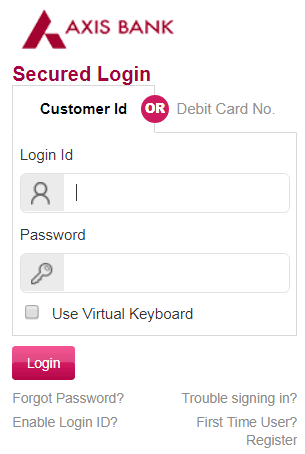

Log In to Axis Bank Internet Banking:

- Visit the official Axis Bank website and log in to your internet banking account using your credentials.

Navigate to Fixed Deposits Section:

- Once logged in, look for the "Fixed Deposits" or "Deposits" section. This is usually located in the main menu or a section specifically dedicated to savings and investments.

Select the Type of Fixed Deposit:

- Choose the type of fixed deposit you wish to open. Axis Bank may offer various options, such as regular fixed deposits, tax-saving fixed deposits, or special term deposits.

Enter Deposit Details:

- Fill in the required details, including the deposit amount, tenure (duration of the fixed deposit), and any other relevant information.

Choose Interest Payout Option:

- Select how you want the interest to be paid out: monthly, quarterly, annually, or at maturity.

Provide Nominee Details:

- If applicable, provide details about the nominee for the fixed deposit.

Review and Confirm:

- Review all the entered information and confirm that it is accurate. Some internet banking platforms may provide a summary for you to double-check before confirming the transaction.

Authenticate the Transaction:

- Depending on the security features of Axis Bank's internet banking, you may need to authenticate the transaction using methods such as OTP (One-Time Password), grid card, or any other security measure.

Confirmation:

- After successfully authenticating the transaction, you should receive confirmation of the fixed deposit creation. This confirmation may include details such as the FD account number and confirmation of the terms.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.