How to Create FD in mobile app:

We can provide you with a useful guide on how to create a Fixed Deposit (FD) in the Axis Bank mobile app.

Creating a Fixed Deposit in Axis Bank Mobile App:

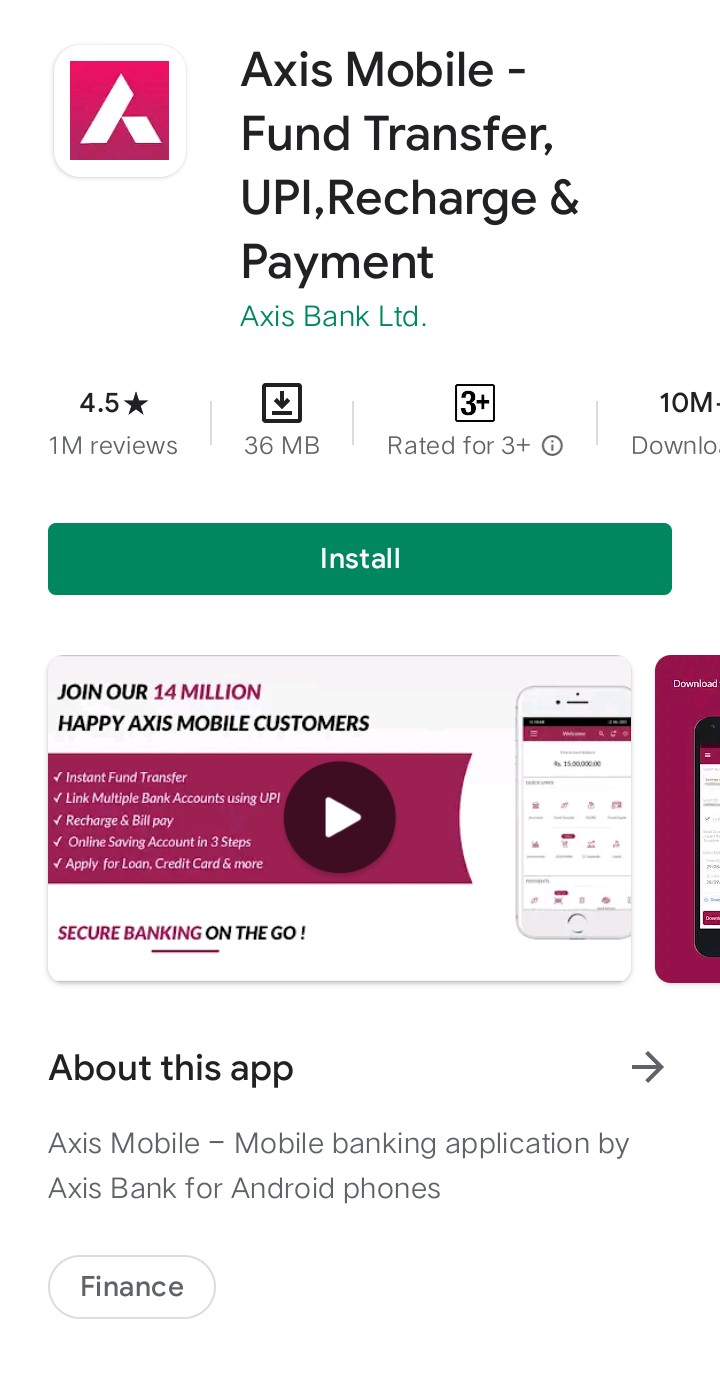

Download and Install the App:

- Make sure you have the Axis Bank mobile app installed on your smartphone. You can download it from the App Store (for iOS devices) or Google Play Store (for Android devices).

Log In:

- Open the Axis Bank mobile app.

- Log in to your account using your username and password or any other authentication method required.

Navigate to Fixed Deposit Section:

- Once you're logged in, navigate to the "Fixed Deposit" or "Create FD" section. This is usually found in the main menu or the section related to "profile" or savings and investments.

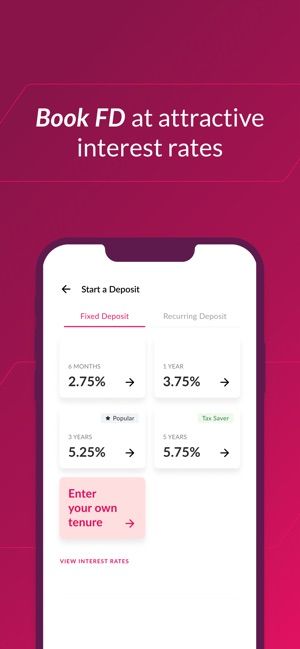

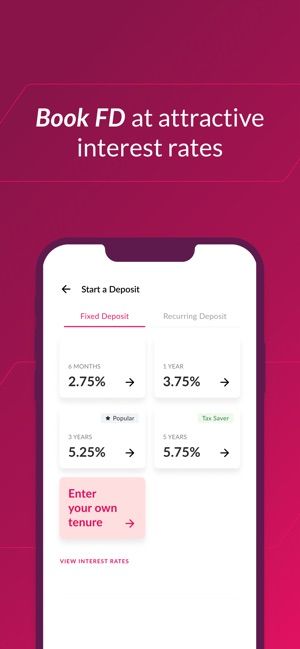

Select FD Type:

- Choose the type of Fixed Deposit you want to create. Banks typically offer various types with different tenures and interest rates. Select the one that suits your needs.

Enter Details:

- Provide necessary details such as the deposit amount, tenure (duration), and any other required information.

Nominee Details:

- Enter details of the nominee if prompted. The nominee is the person who will receive the FD amount in case of unforeseen circumstances.

Review Terms and Conditions:

- Carefully review the terms and conditions associated with the Fixed Deposit, including interest rates, maturity date, and any penalties for premature withdrawal.

Confirm and Authenticate:

- After reviewing the details, confirm your selection. You may be asked to authenticate the transaction using an OTP (One-Time Password) sent to your registered mobile number.

Generate FD:

- Once you've confirmed the details and successfully authenticated the transaction, the bank will generate the Fixed Deposit. You may receive a confirmation message with the FD details.

Monitor Your FD:

- You can monitor your Fixed Deposit in the app, checking its status, maturity date, and interest earned.

* 7.60% Interest rate on Fixed Deposits for

Senior Citizens.

* 7.10% Interest rate on Fixed Deposits for all other.

*t&c apply

How to Create Fd in Internet Banking:

To create a fixed deposit (FD) using Axis Bank's internet banking platform, follow these general steps.

Creating a Fixed Deposit in Axis Bank Internet Banking:

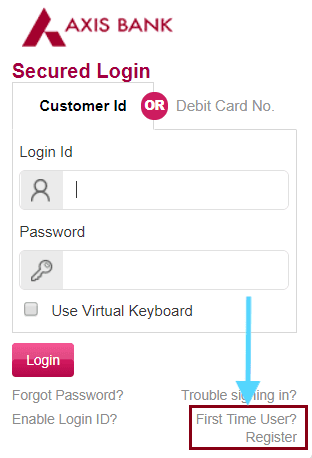

Log In:

- Visit the official Axis Bank internet banking website.

- Log in to your internet banking account using your login id and password.

Navigate to Fixed Deposit Section:

- Look for an option related to Fixed Deposits. This could be under the "Investments" or "Fixed Deposits" section. The exact location may vary.

Select FD Type:

- Choose the type of Fixed Deposit you want to create. Different FD types may have varying interest rates and tenures. Select the one that suits your preferences.

Enter Deposit Details:

- Fill in the necessary details, such as the deposit amount, tenure (duration), and any other required information.

Nominee Details:

- Provide details of the nominee, if required. The nominee is the person who will receive the FD amount in case of unforeseen circumstances.

Review Terms and Conditions:

- Carefully review the terms and conditions associated with the Fixed Deposit, including interest rates, maturity date, and any penalties for premature withdrawal.

Confirm and Authenticate:

- After reviewing the details, confirm your selection. You may need to authenticate the transaction using an OTP (One-Time Password) sent to your registered mobile number.

Generate FD:

- Once you've confirmed the details and successfully authenticated the transaction, the bank will generate the Fixed Deposit. You may receive a confirmation message with the FD details.

Monitor Your FD:

- You can monitor your Fixed Deposit through the internet banking platform, checking its status, maturity date, and interest earned.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.