The process for applying for an ATM card through the YONO SBI app involved the following steps.

Download and Install the YONO SBI App:

- Go to the Google Play Store or Apple App Store, search for "YONO SBI," and download the app on your mobile device.

Register or Log In:

- If you are a new user, you will need to register for the YONO SBI app. If you already have an account, log in using your internet banking credentials.

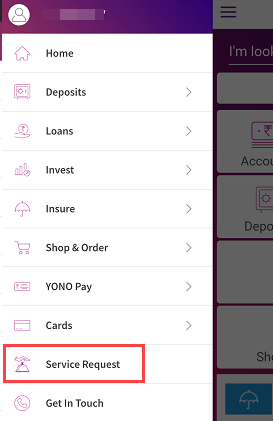

Navigate to the "Services" Section:

- Once you have logged in, find the "Services" section in the app. This section usually contains various options for banking services.

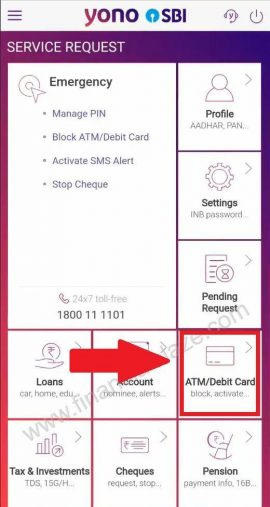

Select "ATM Card Services":

- In the "Services" section, look for an option related to ATM card services or card management. Click on this option to proceed.

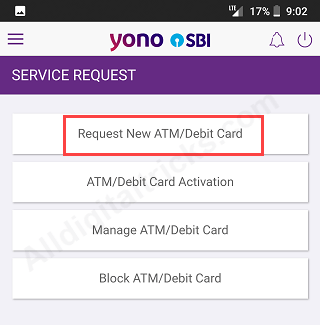

Choose "Request New ATM Card":

- Within the ATM card services, you should find an option to request a new ATM card. Click on this option to initiate the application process.

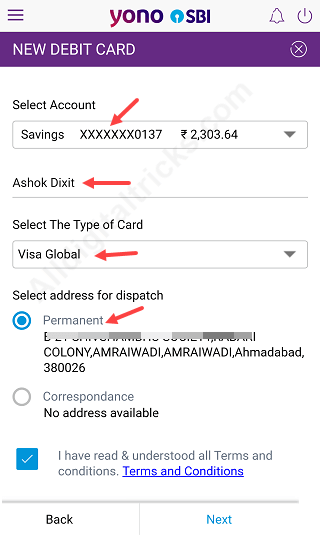

Fill in the Required Details:

- You will likely be asked to provide certain details, such as your account information, personal details, and the type of ATM card you want to apply for.

Review and Confirm:

- Before submitting your application, review all the information you have provided to ensure its accuracy. Once you are certain that all the details are correct, confirm your request.

Wait for Confirmation:

- After submitting your request, you may need to wait for confirmation from SBI. They will process your application and issue the ATM card accordingly.

Receive and Activate the ATM Card:

- Once your application is approved and processed, you will receive your new ATM card at your registered address. Follow the provided instructions to activate the card and set up your PIN.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App