A health card is typically a card issued by a financial institution or healthcare provider that allows individuals to avail themselves of various healthcare services on credit. These cards may be linked to a specific healthcare network or provider.

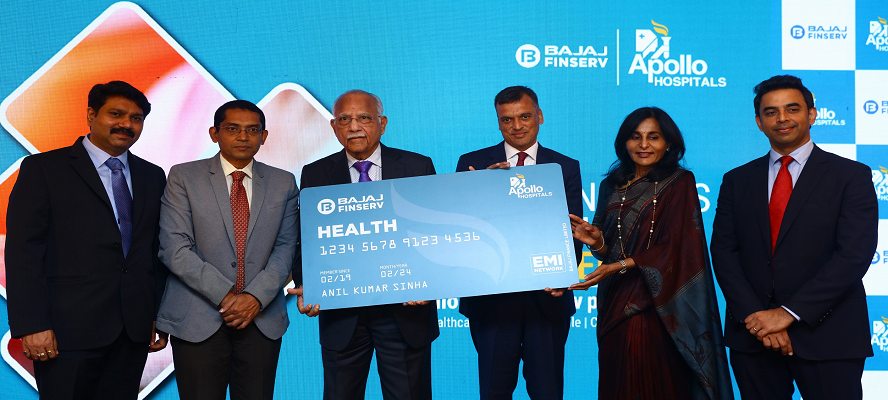

Bajaj Finance, being a well-known financial institution in India, may offer a health card as part of its financial products and services. The specifics of the Bajaj Finance Health Card, including its features, benefits, and terms, would be outlined by Bajaj Finance itself.

The Health EMI Network Card (HEMI) is a digital card used to make payments for healthcare expenses incurred at hospitals. This card comes with a pre-assigned limit of up to Rs. 4 lakh. With this card you can convert all your medical expenses in EMIs of up to 38 months.

This digital-first Bajaj Finserv Health EMI Network card offers coverage of hospital, pharmacy and diagnostic bills together. More importantly, the card can be used at over 5,500 Hospitals & healthcare partners, including Apollo, Manipal Hospitals, Fortis, Narayana Hrudayalaya, Dr. Batra’s, VLCC, Sabka Dentist, Kaya, etc., in more than 1,000 cities in India.

The Bajaj Finserv Health EMI Network card can help avail over 1000+ treatments like Hair Transplants, Cosmetic Treatments, IVF Treatments, Maternity Care, ENT Treatments, Plastic Surgeries, Oncology Treatments, Stem Cell Treatments, Vascular Surgery, Orthopedic Treatments, among others.

What all comes under Bajaj Finserv Health EMI Network Card?

- Loan Limit of up to Rs. 4 lakhs to convert medical expenses into easy EMIs

- Doctor consultations and lab benefits worth Rs.2,500

- Free preventive health check-up package

- 10 Free teleconsultations with doctors

Bajaj Finserv Health EMI Network card- Gold or Platinum coverage?

There are two unique variants: Bajaj Finserv Health EMI Network Card - Platinum and Bajaj Finserv Health EMI Network Card - Gold. It depends on your needs.

The platinum card includes:

- EMI loan limit of upto Rs.4 lakh for converting healthcare expenses into Easy EMIs

- Doctor consultations and lab benefits worth Rs.2,500 at any Hospital, Doctor or lab

- 10 Free teleconsultations with doctors across 35+ specialities, worth Rs.5,000

- 1 Free preventive health check-up package worth Rs.3,000

- The card costs Rs.999, inclusive of GST

The gold card includes:

- EMI loan limit of upto Rs.4 lakh for converting healthcare expenses into Easy EMIs

- 10 Free teleconsultations with doctors across 35+ specialities, worth Rs.5,000

- 1 Free preventive health check-up package worth Rs.3,000

- The card costs Rs.707, inclusive of GST

Here are some general features that health cards may offer:

Credit for Healthcare Expenses: Health cards often provide a pre-approved credit limit that can be used to cover various healthcare expenses, including medical treatments, surgeries, diagnostic tests, and pharmacy bills.

EMI Options: Many health cards come with the option to convert healthcare expenses into Equated Monthly Installments (EMIs), making it more manageable for individuals to pay for costly treatments over time.

Network of Healthcare Providers: Some health cards may have tie-ups with specific hospitals, clinics, and diagnostic centers, allowing cardholders to avail themselves of cashless services within the network.

Interest-Free Period: Some health cards may offer an interest-free period during which the cardholder can repay the borrowed amount without incurring any interest charges.

Easy Application Process: The application process for a health card is usually straightforward, and approval may be quick.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App